Getting your application off the ground requires a couple of things to meet up and funds top the rundown – without the assets, recruiting an application improvement organization or group of inner engineers and planners is preposterous so you need a strong arrangement for pitching financial specialists.

As the marketable strategy has become undesirable as of late, most speculators are more intrigued by your pitch deck. Inside the pitch deck for financial specialists, you need an itemized diagram of a few components in case you're anticipating building an application. Here, we will take a gander at the particular monetary fundamentals that your business needs to pass on as a component of your arrangement for pitching speculators. Your pitch deck for speculators and monetary model A field-tested strategy is a significant arranging resource that used to be a worldview device in a pitch for financial specialists. While this is as yet something business visionaries need to amass, it's become undesirable where the pitch deck for speculators is the favored method to communicate data. Inside your pitch deck, you need to give close consideration to how and what you uncover as a component of your monetary arranging system. Speculators are searching for a few KPIs that detail your application's income stream which is instrumental in persuading them to support your venture.

According to stats, here are the top 10 cities in startup tech funding in which new york is on top with highest funding.

Source: fundz.net

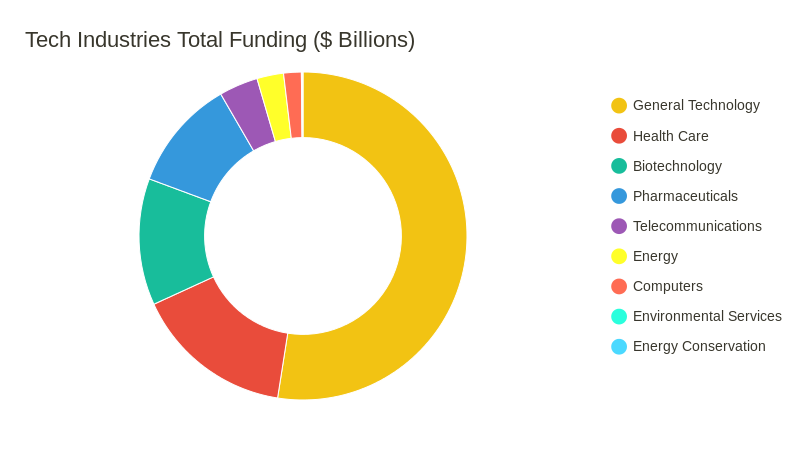

Here are the stats of categories with funding. General category is taking the highest part of total structure.

Source: fundz.net

Best and Monetary KPIs to remember for your pitch deck and to increase funding-

Your arrangement for pitching financial specialists needs to incorporate a small bunch of pointers that grandstand how the application will create income. Ensure you have the accompanying itemized in your pitch deck for speculators.

1. LTV and CAC:

Your K factor is a connection between the lifetime client esteem (LTV) and the client obtaining cost (CAC) – this pointer is basic in passing on the amount it expenses to get a paying client versus the extended pay they will create. A few clients will join naturally which can be considered against the expense of paid missions which is extraordinary as this decreases the normal CAC however it's somewhat hard to ascertain before an application hits the market. The key here is anticipating a comprehension of how your costs go down with each obtained client at that point considering the dynamic change against the worth every client produces for your foundation.

2. Keeping up the K factor:

There is a slight test in keeping up the K factor as the CAC drops with each fruitful change of a paying client. Accordingly, you need to think of a sort of normal at a few purposes of your application's lifecycle that shows this connection on a course of events. Since this worth changes significantly (or should) in the initial while of an application's dispatch, you'll need to unmistakably detail these expenses against the income you hope to procure over this period at that point at last show where it starts to adjust. As expected, you should have the option to pinpoint a more static incentive for the K factor once development turns out to be all the more consistent, ordinarily a while after dispatch.

Also Check: Right Time To Explore Opprtunity In Healthcare App Development

3. Hat:

The all-out addressable market (TAM) concurs with your K factor and shows the open door access for your application. Your TAM ought to practically mirror the complete crowd size that you would like to change over into paying clients.

4. Kind of adaptation:

There are a few different ways to adapt your application however one of the most mainstream is through in-application buys (IAP) and in-application memberships (IAS.) Too, organizations can hope to procure some pay by utilizing portable advertisements which is a typical strategy when offering a freemium model. Simply remember, utilizing promotions normally doesn't yield a lot of pay. Even though there is a 30% charge for utilizing IAP or IAS on either the App Store or Google Play, this is frequently the most secure and most available approach to acquire payment in your application.

6. Long haul item vision:

Your MVP will in all likelihood create considerably less pay when contrasted with a completely evolved application. You'll have to have some sort of understanding concerning what it will cost to increase your application with new highlights so, all in all, you can factor this against your procuring projections. By and large, your application will increment in likely profit as it is scaled to accomplish more. Speculators need to see development to ensure that your future advancements will serve to improve the application and not set it back.

SchultzCode Technologies can assist you with pulling in financial specialists At SchultzCode Technologies, we utilize the most elite to construct programming for everybody from the sole business person to the Top organization. We realize how to scatter all the monetary subtleties to help you make your item appeal to speculators. Connect with us to study how we can construct your advanced item as well as assist you with refining your arrangement for pitching speculators.

03 Jan 2021

Our Blog

Developing high people management standards to encourage personal development, professional excitement and employee retention.