Our lives are now centered on Smartphones. They play the role of cameras, phones, web browsers, and are in the most important way of keeping in touch with the routine of daily life. Smart devices are always in our hands and pockets and have the power to replace other common items such as a wallet.

An electronic wallet sometimes called "digital wallet" or "e-wallet" is an electronic payment card system that allows you to conduct transactions on your behalf. These pockets are usually available on mobile devices such as smartphones, but desktops and laptops can also hold electronic devices.

An electronic wallet must be attached to a specific debit or credit card for proper operation. You may also need to link your electronic wallet to your bank account. Next, using information and software, consumers can use a wallet to pay for items instead of carrying cash or a physical card.

What is e-wallet and what are the advantages of using e-wallets-

What is Mobile wallet or e-wallet-

An e-wallet is a digital system that stores personal payment details. 'Digital' means it only exists with a computer. Safe, online wallet. The term is abbreviated as' electronic wallet, 'that is,' e 'w e-wallet represents' electronic. 'We also say it's a digital wallet.

A digital wallet (or e-wallet) is a software-based system that stores secure payment details for users and passwords for multiple payment methods and websites. By using a digital wallet, users can complete purchases easily and quickly with communication technology located in a nearby field. And they can create strong passwords without having to worry about being able to remember them over time.

The usage of e-wallets keep increasing, you can look at following states to know.

e-wallet usage statistics-

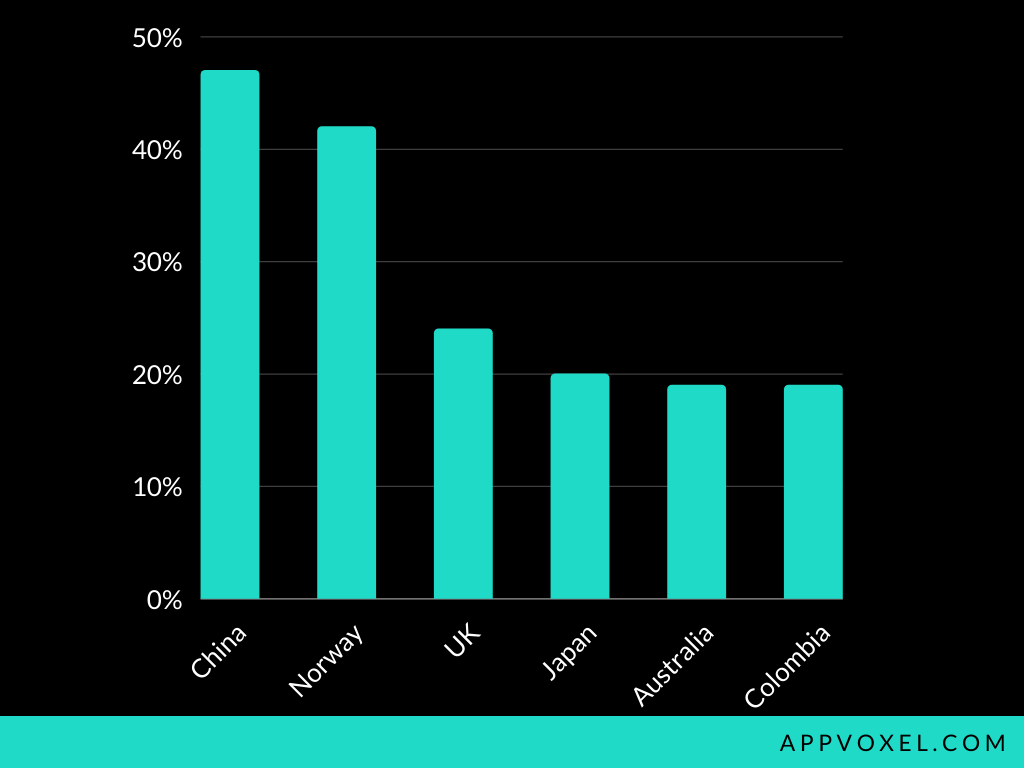

According to states, China is the country where the usage of e-walletss apps are highest. In UK the usage of e-wallets app is 24%. The top 5 countries where e-wallets are highly used are China, Norway, UK, Japan, Australia, and Colombbia.

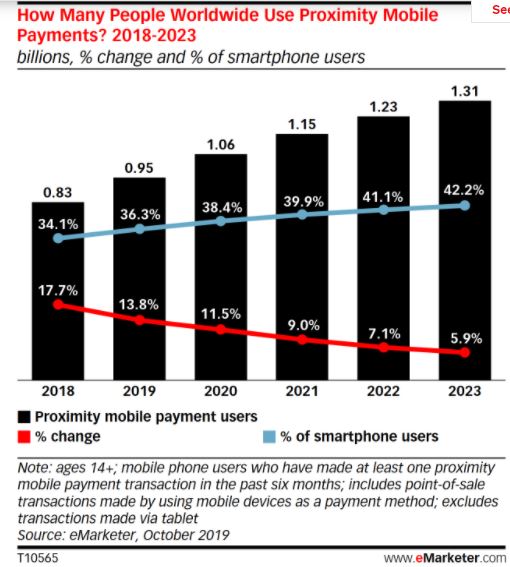

According to eMarketer states there will be huge spike of e-wallet users till 2023.

What are the types of mobile wallet or e-wallet-

Mobile pockets or e-wallets are divided into three main categories: closed, closed, and open.

Closed wallets are connected to a retailer or private company where you can only spend money on direct purchases from a particular retailer. Money from these funds cannot be transferred to your bank account. The best example of closed wallets is amazon pay.

The Semi-Closed wallets can be used with most retailers as long as they have a contract with the payment portal. Although you can withdraw money from unlocked wallets in your bank account, you cannot withdraw it as cash. The best example of closed wallets is Paytm.

Open wallets, on the other hand, are not limited to the other two. This type of wallet is issued directly by the bank or through them to a third party. The money in this wallet can be used for any transaction and users can withdraw money withdrawn from their account in cash. The best example of open wallets Paypal.

How Does e-wallet work?

The initial setup of the e-wallet requires a trust of customers. They should trust that their information will remain secure not only on their smartphone but also at the E-wallet provider's storage location. To get started technically, customers must enter their bank account and credit card details as these are the areas where their funds will be deducted when the payment period arrives.

Fund E does not contain cash. It is up to the customer to decide when or if he or she wishes to invest.

Payment transactions can be defined as an encrypted transaction between two banks: a customer and a merchant. E-wallet payments are beneficial to consumers and retailers alike because of their high-security agreements and the fact that customer credit card details are not as well known to the merchant as they used to be when using electronic line cards.

The transaction proceeds quickly and securely, with money issued from the customer's E-wallet or bank balance and sent in seconds to the seller.

Once the process is complete, both parties get what they expect; the customer receives the product or service, and the seller is properly paid for the purchase.

Complete records are kept by the merchant services provider and the client's e-wallet client, which enables everyone to respond when any questions or disputes arise.

As this can be a new way to send money to others, we decided to provide a blog post to explain how a wallet works. After all, it is one of the easiest ways to transfer money overseas.

Advantages of e-wallets-

Better usability:

If you carry an electronic wallet, you can limit the amount of debit/credit cards you carry with you when traveling. There is no need to handle large amounts of money at any time. All you have to do is tap your device to pay or scan your mobile device to pay for what you buy. This reduces the burden of carrying too many items in your pocket through the process.

Also Check: Advantages Of Having Mobile App For Your Business

2. Access to many types of cards:

Electronic wallets often store credit and debit cards. However, it can be used for a variety of cards if it is compatible with the provider's wallet. This means that reward cards, loyalty cards, and even coupons can be stored in a digital wallet, so you can enjoy a paperless lifestyle.

3. More safety:

If a chunk of money in your pocket is lost, you have a few options available to collect your funds. If you lose your credit card, you will need to contact all creditors to cancel each card and issue a new one. In an electronic wallet, details are kept by a third-party provider. Locked behind a password or biometric. If you lose your device, you can still access your e-wallet when you find a new device.

Also Check: Zoom Business Model-How Zoom Makes Money

4. Used in retail and online stores alike:

Electronic bags have become increasingly popular over the past few years. In most places that accept cards as a payment option, you can pay with an electronic wallet. Although there are still sites that use older processing technologies that limit access to other products and services, the number of retailers that provide access to payment in this way continues to grow year on year.

5. Authorized transactions:

An electronic wallet serves as a bank card when you start a transaction. You must enter a PIN to enable payment. For devices with biometric authentication, fingerprint verification is required for payment. This promotes security in the financial risks associated with fraudulent purchases and identity theft.

6. Exciting rewards:

Many e-wallets provide incentives to encourage consumers to use them instead of traditional payment methods. Discounts may apply to certain purchases such as fuel, food, and travel. Some businesses can use an electronic wallet to offer certain discounts. That means you can save money without changing the way you spend money and just change the payment method for those things.

7. Help organize your budget:

Many e-wallets will help you keep track of your spending habits. Others produce reports that highlight specific areas of expenditure. You can also allocate a fixed budget at a certain cost level to avoid spending extra money on certain items. However, if you buy expensive products, you can disable this feature and make sure you have enough money to pay for it.

8. Immediate money transfer:

Funds make transfers and remittances faster and easier. In addition, there are currently no transaction fees set for transfer anywhere, at any time. Therefore, it is the most preferred method.

9. The structure of the division of the Bill:

Another important benefit is the ability to split expenses with friends. E-wallet users can split invoices by simply entering the number of people waiting to pay the share. These bags automatically create a link that can be sent to the borrower.

10. Enrich options:

The biggest advantage of cell phones or wallets is the available option. There are many options available in the bags so that users can use them to their satisfaction.

11. Easy to load money:

You can easily add money to your wallet with a net bank, credit card, or bank card. Because you can store this information, you save time without having to enter this information each time you make a transaction.

Conclusion-

Using an e-wallet can make your life easier as it has a lot more advantages.

At SchultzCode Technologies, we have the best and experienced developers and they have knowledge of every latest trend and market. If you want to develop something or you have a doubt, just reach us and we will provide you the solution.

01 Feb 2021

Our Blog

Developing high people management standards to encourage personal development, professional excitement and employee retention.